June 11, 2021 | Market Notes

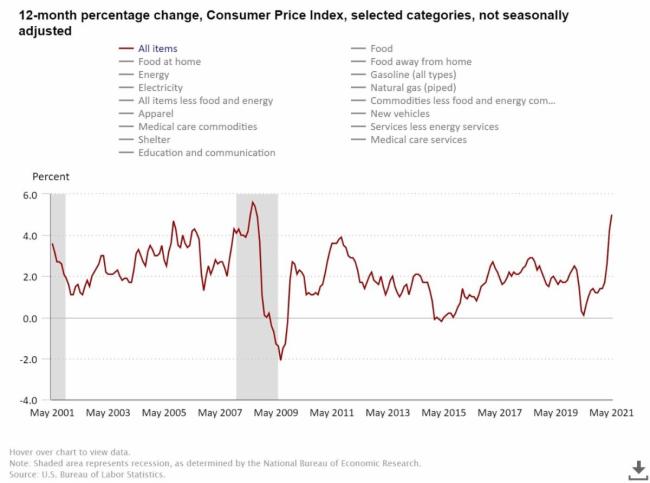

In recent months, the financial markets and economic data have signaled that inflation is back, maybe in a big way. Last month, the Bureau of Labor Statistics (BLS) indicated that in April, core inflation (ex-food & energy) rose at the fastest pace since 1981, while headline Consumer Price Index (CPI) posted its fastest increase since 2008. If you have been out shopping or read the financial news, you have probably noticed that prices are going up – the price of food, gas, houses, and cars, as well as the prices of many things used to create finished goods. In other words, the things that most people spend most of their money on.

Yesterday, the BLS reported that the May CPI rose 5% year/year (+0.6% month/month), higher than the 4.7% estimated and the 4.2% year/year figure in April; “core” inflation rose 3.8% year/year (+0.7% month/month) vs. +3.5% estimated and +3% in prior month. The headline number was the highest since August 2008 and core inflation highest since May 1992.

It’s true inflation rates were low during the spring of 2020 as the prices of many things were depressed because of the shutdowns. Therefore, it’s not unreasonable to expect at least a few months of distortion in the numbers when comparing to the COVID depressed levels of a year earlier. In addition, the shutdowns did cause significant disruption of global supply chains, and to the extent supply remains constrained as demand snaps back with re-opening, this will continue to put upward pressure on prices.

The Fed’s official line is that inflation will be “transitory” until supply chains adapt to the post-COVID world and economic conditions normalize. With the release of the May inflation figures yesterday, government officials rushed to assure markets, with the White House Council of Economic Advisors tweeting: “Much of the annual inflation was due to base effects, reflecting the depressed prices from last spring. Controlling for base effects by smoothing across the 15 months since February 2020, the rate of CPI inflation was 3%. In core inflation, controlling for base effects the rate of annualized CPI inflation was 2.6%.”

Perhaps inflation will be transitory, but it’s important to note that a year ago, Fed officials were saying nothing about an inflation spike 12 months in the future. It’s fair to say the Fed’s economic prognostications over the years have been poor, though evidence suggests they have been slightly more accurate than private forecasts. Those who currently buy into the transitory narrative point to the bond market and the fact that while the yield on the 10-year Treasury spiked up to nearly 1.75% at the end of March, it has now traded in the ~1.5% range for weeks and trades lower than that with the release of the May inflation data yesterday.

Given that bond investors are often referred to as “the smart money” on Wall Street, many take this signal at face value, saying “see? The bond market is not worried about inflation, so nothing to see here!” The problem is, it’s difficult if not impossible to compare this to any historical business cycle as there is simply no analog to the government imposed economic shutdowns that took place last year and which were still happening in parts of the world into this year. Couple that with the unprecedented amounts of monetary and fiscal stimulus because of CV19 and we have no way to know what distorting effects they are having on markets and pricing mechanisms.

Indeed, the Fed has purchased more than 57% of all Treasuries issued since October 2019. Other central banks such as the European Central Bank intervene as much if not more than the Fed in the fixed income markets overseas. Are these markets transmitting prices the way they have historically with all the artificial rate suppression? Simple math suggests no. If you assume an investor in US debt demands a real return, then nominal rates would necessarily rise when inflation expectations rise. Nominal yield = real yield + inflation, and with the yield on the 10-year Treasury currently trading around 1.45%, real yields are negative when taking inflation into account, arguably deeply negative given the current inflation numbers and the fact that inflation has averaged about 1.7% annually over the past decade.

If you made the ridiculous assumption that inflation now is the same as the 1.7% of the past 10 years, then with the 10-year Treasury yielding 1.45%, that means the real yield would be -0.25%. If you subtract the May CPI of 5.0%, the real yield would be -3.55%! This doesn’t even consider that a taxable investor would have to pay taxes on any interest income received. Given that, why would an investor buy a Treasury bond right now? Back in the old days, the yield on the 10-year Treasury would typically mirror nominal GDP growth, but that relationship has broken down with all the central bank intervention of recent decades. This is only confirmed by the fact that as of June 9, the government officially forecasts the economy to grow 6.6% in 2021. Back in the “old days” prior to post-Volcker activist Fed, the yield on the 10-year Treasury would be ripping north of 5% right now.

While it’s safe to say the bond market is not the transmission mechanism it once was, the prices of many things, including housing and financial assets, are going up at the fastest rate in years if not decades. Many, but not all, traditional inflation hedges such as commodities and real estate, have been doing very well recently. Gold is an exception – though it has perked up recently it remains ~10% below its levels of last August.

Even with the Fed pledging to hold rates low for long, all evidence would still point to an upside bias in rates if growth and inflation continue to go up. In this scenario, interest rate sensitive sectors of the bond market, like Treasuries, would continue to be vulnerable, like the pain felt at the beginning of this year. Unless presented with contrary evidence, we would continue to underweight rate-sensitive bonds and fixed income in general and have taken steps to position client portfolios for inflation.

We believe inflation remains an elevated risk to prepare for, but the arguments for transitory inflation are not without merit. A real challenge for the Fed will be if inflation persists. The textbook reaction would be for the Fed to “taper” asset purchases and raise rates, something Jay Powell said “they aren’t even thinking about thinking about” not that long ago. However, other Fed officials have made comments in recent weeks which suggest discussion is underway about how to deal with persistent inflation.

There’s no question a meaningful move higher in rates like in late 2018 would make stocks vulnerable. Back then, the Fed was fading its bond buying and had increased rates a few times, and it really seemed like Jay Powell was going to keep his promise to unwind the “emergency” measures that were taken in response to the Great Financial Crisis like “Quantitative Easing (QE)”. Then, the 10-year Treasury spiked above 3%, the market threw a tantrum, and stocks sold off 20% in the 4th quarter of that year. That mini-crash spooked the Fed and it reversed course, eventually lowering rates 3 times in 2019, even before it took them back down to zero during the pandemic. With the Fed’s current stance, worries about a similar episode now seem premature.

While upside surprises have fallen off, economic data and corporate profits remain robust. Stock markets continue to trade at or near all-time highs even while trading sideways for much of the past couple months. Valuations remain historically elevated, even as volatility has continued to fall like it has for much of the past year. While sentiment indicators remain overwhelmingly positive, it seems like the mildest sell-off sets investors on edge, suggesting people are aware the market feels frothy, with all the excitement over crypto-currency, meme stocks, and other speculative vehicles.

We recognize that much optimism about the economy and re-opening is already priced into the market. Nevertheless, our indicators continue to flash green and economic data could certainly gain upside momentum again as more people return to the workforce and conditions normalize. Whatever happens, if we have good reason to believe markets are changing, we will position portfolios accordingly.

Please call us if you would like to discuss your account.

|